Collector Penalties

Consumers benefit from stringent financial policies that impose significant penalties on creditors for violations. Major financial institutions like Wells Fargo and Bank of America have faced such penalties. Understanding your rights and recognizing violations can greatly help in safeguarding your financial well-being.

Truth in Lending Act (TILA)

The TILA ensures that consumers receive clear and standardized information about credit terms. Creditors are required to provide transparent and concise disclosures, helping consumers make informed decisions.

Consumer Financial Protection Act (CFPA)

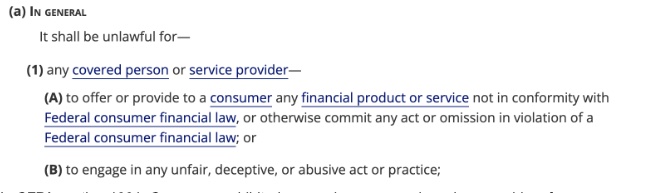

Consumer Financial Protection Act (CFPA)

Section 1036(a)(1)(B), 12 U.S.C. 5536(a)(1)(B)

The CFPA, under Section 1031, prohibits unfair, deceptive, or abusive acts or practices by covered persons and service providers in the offering of consumer financial products or services.

Fair Debt Collection Practices Act (FDCPA)

Monetary and Non-Monetary Damages:

- Physical Distress: Consumers can recover treatment costs resulting from a collector’s actions.

- Emotional Distress: Compensation is available for emotional suffering caused by debt collectors.

- Lost Wages: If debt collection efforts impact employment, consumers can seek recovery of lost wages.

- Statutory Damages: Up to $1,000 can be awarded per lawsuit for FDCPA violations, regardless of the number of violations. Examples

include: - Repeated phone calls

- Use of abusive or profane language

- Calls during prohibited times

- Threats or use of violence

- Contacting third parties about the debt

- Contacting you at work

- Misleading or lying about your debt

- Failing to verify the debt

- Failing to identify as a debt collector

Courts can also issue injunctions to stop certain debt collection activities, such as calls and letters. Family members, coworkers, or friends affected by third-party debt collectors can sue for damages up to $1,000.

Telephone Consumer Protection Act (TCPA)

Consumers can recover up to $500 for each violation of the Do Not Call Registry rules, and up to $1,500 if the violation is shown to be knowing and willful. Unlike FDCPA violations, there is no maximum cap on TCPA violations, and the statute of limitations for these cases is four years.

For more information, refer to the [TCPA rules]